Nonetheless, This may be hedged by any spinoff product or service that has a long term amount of interest as one among its parts.

It can be The essential charge. Traders can contend with spot amount contracts dependant on a specific charge and give a conservative revenue on a sale. This limitation may be defeat by purchasing much more dynamic items with futuristic rates.

Such a agreement can be a ahead contract whereby the customer can e-book the product at a level that is a little better in comparison to the spot amount (such as the seller's premium), also known as the forward level, and take the shipping afterwards, As a result making income within the then spot charge.

Knowing the potential advantages of ETFs is a vital step toward determining no matter whether ETFs can be an appropriate choice for your portfolio.

This really is why traders may want to take into consideration complementing their one stock allocations using a extensive-time period investment tactic that aims to maintain you on track to fulfill your long term fiscal targets, regardless of the effectiveness of an individual inventory.

In fastened cash flow, setting up a yield curve making use of information from governing administration securities or large-good quality corporate bonds is typical for estimating spot rates.

For instance, if a firm expects to obtain payments within a foreign forex in a particular interval, it can use a forward amount to ensure the quantity it can receive and avoid adverse Trade price fluctuations.

eight This Instrument is for informational needs only. You should not construe any facts supplied listed here as investment assistance or even a recommendation, endorsement or solicitation to acquire any securities offered on Yieldstreet. Yieldstreet is not really a fiduciary by advantage of any person's use see page of or entry to this tool.

A spot price’s price is based in aspect on the quantity that purchasers pays and the quantity that sellers are prepared to get, which typically hinges on a number of elements like supply and demand, current and predicted upcoming market value, in addition to things that will influence the whole market: interest rates, geopolitical gatherings for example wars, and overall market sentiment.

The spot rate for your look at these guys offered time period is observed by observing the generate to maturity with a zero-coupon bond for that time period.

2 see page Signifies an Web annualized return, making use of an interior level of return (IRR) methodology, with respect towards the matured investments proven inside your Portfolio knowledge, using the effective dates and quantities of subscriptions and distributions to and from the investments, Internet of management charges and all other bills charged to your investments. With respect towards the “Portfolio Overview” look at, a blended Web annualized return is revealed.

One crucial hyperlink amongst the two is the fact that ahead rates are derived from spot pricing, modified by aspects like interest level differentials amongst two currencies or the price of carrying a commodity.

And diversification is essential to thriving investing. Spreading money throughout assorted asset classes helps you to mitigate risk and guard towards inflation.

In lieu of acquiring particular person stocks, traders obtain shares of the fund that targets a representative cross-area of the broader market. However, there is often extra expenditures to bear in mind when purchasing an ETF.

Scott Baio Then & Now!

Scott Baio Then & Now! Brian Bonsall Then & Now!

Brian Bonsall Then & Now! Destiny’s Child Then & Now!

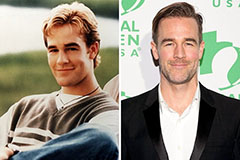

Destiny’s Child Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now!